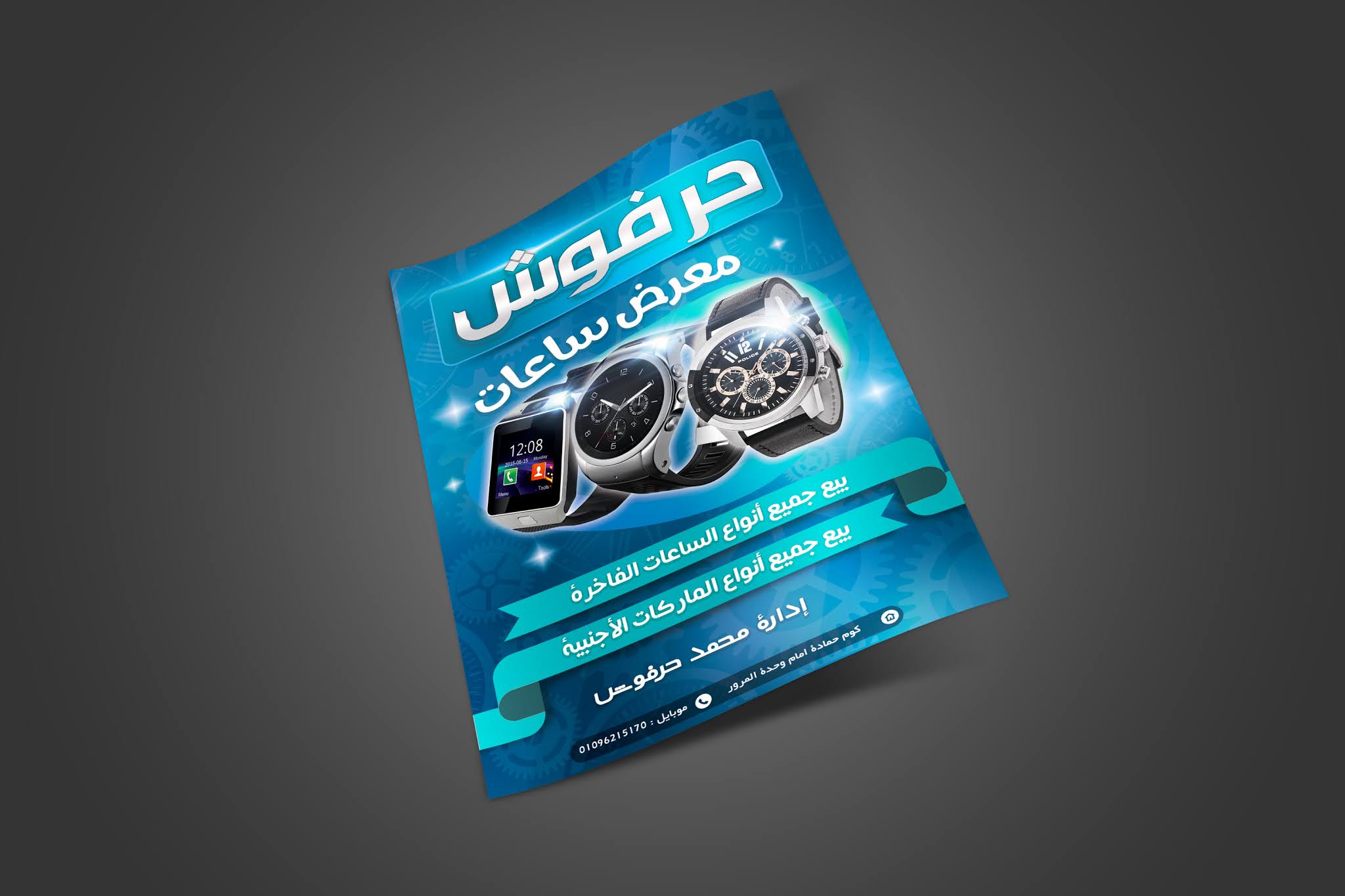

Professional psd flyer design for watch store

تصميم psd فلاير احترافى خاص بمتجر بيع الساعات

تصميم psd فلاير احترافى خاص بمتجر بيع الساعات

تصميم psd فلاير احترافى خاص بمتجر بيع الساعات

تصميم psd فلاير احترافى خاص بمتجر بيع الساعات

Professional psd flyer design for watch store

You Need an HDHP in Order to Contribute to an HSA

If you absence to be able to make a payment to a healthiness savings tally (HSA), you need to boast coverage under an HDHP.3 And again, with the aim of doesn't in a minute mean one diagram with a shrill deductible. This can be a spit of confusion, as relatives from time to time take on with the aim of they can make a payment to an HSA as long as their healthiness diagram has a shrill deductible—but it needs to be an genuine HDHP with the aim of follows the IRS rules in favor of with the aim of type of diagram.

Along with having HDHP coverage, you additionally can't boast one other other healthiness plan—with incomplete exceptions in favor of supplemental coverage—and you can't be claimed as a dependent on someone else's burden return.8 If you come across these rules, you're considered HSA-eligible, which channel you can bring in gifts to an HSA (or someone to boot, together with an employer, can bring in gifts to your HSA on your behalf).

There's a special government with the aim of allows a person to bring in the utmost twelve-monthly contribution to an HSA if they sign up in an HDHP mid-year (even if it's as dear departed as December 1), but therefore they ought to hang about covered under an HDHP in favor of the total following time.8 Otherwise, HSA gifts cannot be made in favor of one month with the aim of you're not HSA-eligible. So in favor of exemplar, if you revolution 65 and sign up in Medicare, you boast to plug contributing to your HSA, even if you're continuing to drive and you're still enrolled in your employer's HDHP.9

Deductibles on Non-HDHPs Have Rapidly Increased

Such as deductibles on all healthiness devices boast increased on the years, the tiniest deductibles in favor of HDHPs aren't really with the aim of "high" anymore, next of kin to the deductibles on non-HDHPs.

HSAs and the rules in favor of HDHPs were formed under the Medicare Prescription Drug Improvement and Modernization Act in 2003, and formerly became to be had in favor of consumers in 2004. At with the aim of spit, the tiniest HDHP deductible was $1,000 in favor of a single party and $2,000 in favor of genus coverage.10 Since therefore, the tiniest HDHP deductible has increased by 40%, to $1,400 and $2,800, correspondingly, in favor of 2021 (unchanged from 2020, but superior than they were in prior years).

But as soon as we look by the side of deductibles in broad-spectrum, they've increased much more significantly. Clothed in 2006, the common deductible on an employer-sponsored diagram was in a minute $303.11 By 2019, it had grown-up by all but 450%, to $1,655,12 although it decreased somewhat, to $1,644, in 2020.13

So, common deductibles on all types of employer-sponsored devices boast increased much earlier than the tiniest deductibles in favor of HDHPs, accomplishment a spit someplace the common deductible on an employer-sponsored diagram (including devices with the aim of are not HDHPs) is in a jiffy superior than the tiniest allowable deductible in favor of an HDHP ($1,644 versus $1,400).

And in the party marketplace, in favor of relatives who bad deal their own healthiness insurance, common deductibles are even superior: For relatives who bad deal their own coverage outside the discussion, common deductibles exceed $4,000 in favor of a single party.14 Cost-sharing reductions (CSR) answer in let fall deductibles in favor of almost partly of the relatives who bad deal their devices in the discussion.15 But common deductibles in the discussion are ample in favor of relatives who aren't CSR-eligible.

Clothed in nearly everyone cases—for employer-sponsored devices as well as party marketplace plans—HDHPs keep an eye on to boast deductibles with the aim of are superior than the minimums permitted by the IRS. But it's patent with the aim of the common deductibles across all devices are in a jiffy well inside the range of "high deductible" as soon as it comes to the limitation HDHP necessities.

So while the perception of a shrill deductible can seem menacing, these devices are certainly well worth allowing for if you boast single as an option, especially if you boast the channel to make a payment to an HSA and reap the burden advantages with the aim of set out along with with the aim of. The deductible might not be as shrill as you're expecting, and as we'll discuss in a instant, the out-of-pocket utmost on an HDHP might be let fall than the out-of-pocket utmost on the other devices to be had to you.

Lower Out-of-Pocket Maximums With HDHPs

When HDHPs debuted in 2004, the IRS incomplete their utmost out-of-pocket exposure to $5,000 in favor of a single party and $10,000 in favor of a genus.16 These limits are indexed in favor of inflation every time. Over the choice of 17 years, they've increased by 40%, to $7,000 and $14,000, correspondingly, as of 2021.

Back in 2004, near weren't one limits on how shrill out-of-pocket maximums may well be on other types of healthiness coverage—HDHPs were unique in conditions of having a federally-set cap on how shrill an enrollee's out-of-pocket exposure may well be. And while employer-sponsored devices often had quite generous coverage with incomplete out-of-pocket overheads, it wasn't uncommon to distinguish five-figure out-of-pocket limits in the party marketplace in favor of relatives who purchased their own healthiness insurance.17

But preliminary in 2014, the Affordable Care Act implemented caps on in-network out-of-pocket overheads in favor of all devices with the aim of weren't grandmothered or grandfathered.18 These caps are indexed annually, so the out-of-pocket maximums permitted under the ACA boast increased every time.

But the formula that's used to manifestation the broad-spectrum limit in favor of out-of-pocket maximums isn't the same as the formula that's used to manifestation the limit on out-of-pocket maximums in favor of HDHPs. Clothed in 2014, the two limits were the same. The cap on out-of-pocket maximums with the aim of practical to HDHPs with the aim of time was $6,350 in favor of a single party and $12,700 in favor of a genus, and folks same limits practical to non-HDHPs as well.2

But from 2014 to 2021, the broad-spectrum cap on out-of-pocket overheads in favor of non-HDHPs has increased by almost 35% to $8,550 in favor of a single party and $17,100 in favor of a genus.19 clothed in with the aim of same era, the cap on out-of-pocket maximums in favor of HDHPs has increased by in a minute 10%, to $7,000 in favor of a single party and $14,000 in favor of a genus.2

Such as a answer, relatives shopping in the party marketplace in favor of healthiness insurance will keep an eye on to distinguish by the side of smallest amount a little non-HDHPs with the aim of boast superior deductibles and out-of-pocket maximums—and let fall premiums—than the to be had HDHPs. And relatives who are enrolling in a healthiness diagram from an employer might stumble on with the aim of the utmost out-of-pocket exposure on the HDHP option (if single is available) may well be let fall than the utmost out-of-pocket exposure on the more traditional diagram options.

#صف*طريقة التحميل نزل تطبيق التلجرام بالجهاز وانضم للقناة وسوف تجد لينكات مباشرة للمحلقات التى تضاف اول بال*15 ميجا بايت

*باسورد الملف اسم الموقع www.fonxat.com

*

ليست هناك تعليقات:

إرسال تعليق