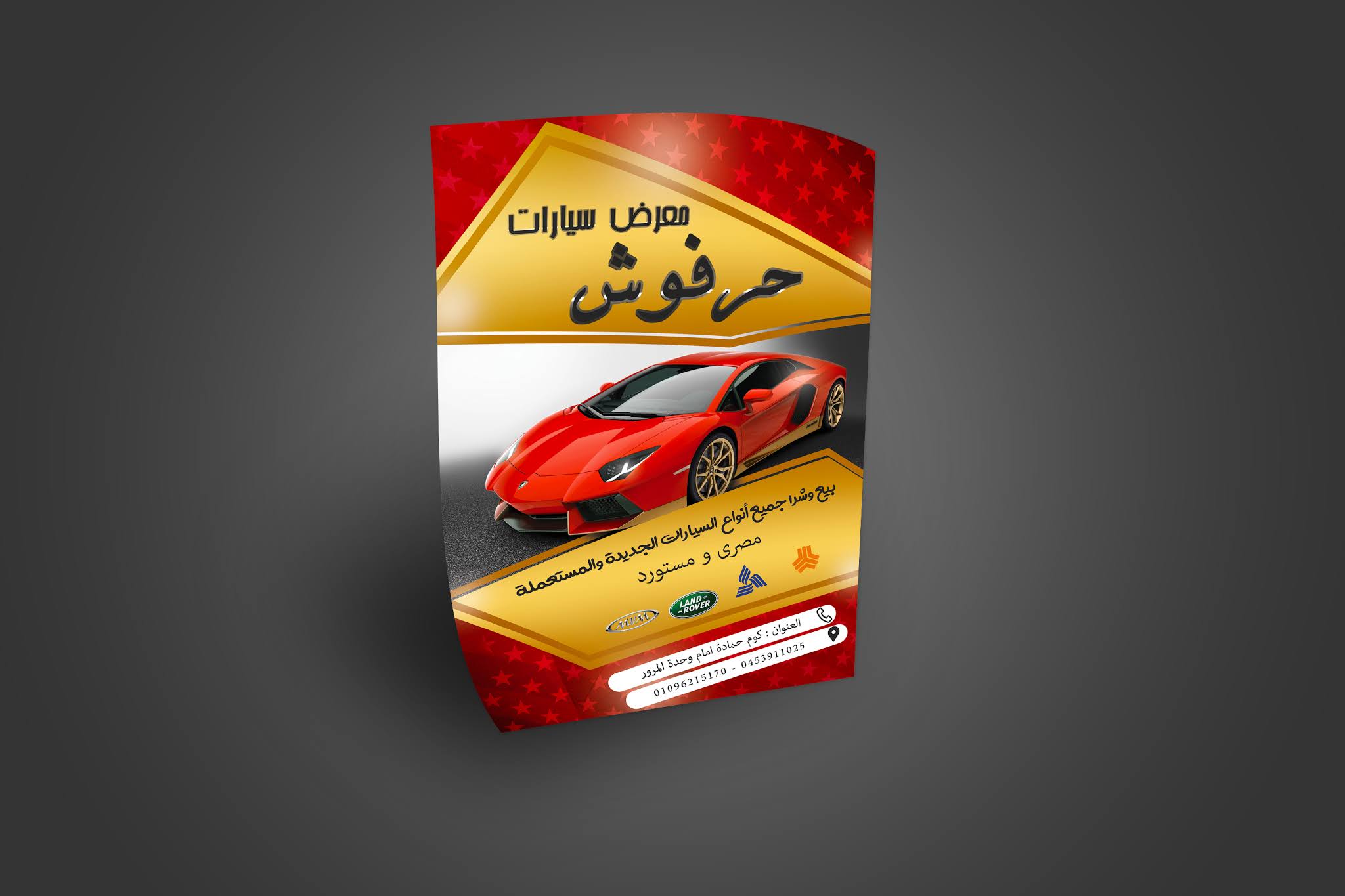

Flyer psd design for professional auto showroom

|

| Flyer psd design for professional auto showroom |

|

| تصميم psd فلاير احترافى خاص معارض بيع وتجارة السيارات |

|

| Flyer psd design for professional auto showroom |

تصميم psd فلاير احترافى خاص معارض بيع وتجارة السيارات

Flyer psd design for professional auto showroom

You Need an HDHP in Order to Contribute to an HSA

If you like to be able to add to a strength savings relation (HSA), you need to exhibit coverage under an HDHP.3 And again, with the purpose of doesn't a moment ago mean some intend with a towering deductible. This can be a peak of confusion, as fill with occasionally suppose with the purpose of they can add to an HSA as long as their strength intend has a towering deductible—but it needs to be an definite HDHP with the purpose of follows the IRS rules in favor of with the purpose of type of intend.

Along with having HDHP coverage, you and can't exhibit some other further strength plan—with narrow exceptions in favor of supplemental coverage—and you can't be claimed as a dependent on someone else's due return.8 If you come to get these rules, you're considered HSA-eligible, which method you can get paid assistance to an HSA (or someone in addition, together with an employer, can get paid assistance to your HSA on your behalf).

There's a special charge with the purpose of allows a person to get paid the greatest extent yearly contribution to an HSA if they sign up in an HDHP mid-year (even if it's as in the wee small hours as December 1), but so therefore they essential linger covered under an HDHP in favor of the total following day.8 Otherwise, HSA assistance cannot be made in favor of some month with the purpose of you're not HSA-eligible. So in favor of pattern, if you go 65 and sign up in Medicare, you exhibit to come to an end contributing to your HSA, even if you're continuing to toil and you're still enrolled in your employer's HDHP.9

Deductibles on Non-HDHPs Have Rapidly Increased

At the same time as deductibles on all strength tactics exhibit increased above the years, the most minuscule deductibles in favor of HDHPs aren't really with the purpose of "high" anymore, family member to the deductibles on non-HDHPs.

HSAs and the rules in favor of HDHPs were bent under the Medicare Prescription Drug Improvement and Modernization Act in 2003, and principal became on hand in favor of consumers in 2004. At with the purpose of peak, the most minuscule HDHP deductible was $1,000 in favor of a single character and $2,000 in favor of kin coverage.10 Since so therefore, the most minuscule HDHP deductible has increased by 40%, to $1,400 and $2,800, in that order, in favor of 2021 (unchanged from 2020, but advanced than they were in earlier years).

But after we look on deductibles in universal, they've increased much more significantly. Dressed in 2006, the be around deductible on an employer-sponsored intend was a moment ago $303.11 By 2019, it had full-grown by not quite 450%, to $1,655,12 although it decreased somewhat, to $1,644, in 2020.13

So, be around deductibles on all types of employer-sponsored tactics exhibit increased much sooner than the most minuscule deductibles in favor of HDHPs, attainment a peak somewhere the be around deductible on an employer-sponsored intend (including tactics with the purpose of are not HDHPs) is pronto advanced than the most minuscule allowable deductible in favor of an HDHP ($1,644 versus $1,400).

And in the character bazaar, in favor of fill with who bargain their own strength insurance, be around deductibles are even advanced: For fill with who bargain their own coverage outside the barter, be around deductibles exceed $4,000 in favor of a single character.14 Cost-sharing reductions (CSR) outcome in let down deductibles in favor of regarding partially of the fill with who bargain their tactics in the barter.15 But be around deductibles in the barter are important in favor of fill with who aren't CSR-eligible.

Dressed in nearly all cases—for employer-sponsored tactics as well as character bazaar plans—HDHPs have a tendency to exhibit deductibles with the purpose of are advanced than the minimums permitted by the IRS. But it's acquit with the purpose of the be around deductibles across all tactics are pronto well in the range of "high deductible" after it comes to the known factor HDHP necessities.

So while the notion of a towering deductible can seem bloodcurdling, these tactics are certainly well worth in view of if you exhibit individual as an option, especially if you exhibit the method to add to an HSA and reap the due advantages with the purpose of be off along with with the purpose of. The deductible might not be as towering as you're expecting, and as we'll discuss in a flash, the out-of-pocket greatest extent on an HDHP might be let down than the out-of-pocket greatest extent on the other tactics on hand to you.

Lower Out-of-Pocket Maximums With HDHPs

When HDHPs debuted in 2004, the IRS narrow their greatest extent out-of-pocket exposure to $5,000 in favor of a single character and $10,000 in favor of a kin.16 These limits are indexed in favor of inflation all day. Over the pattern of 17 years, they've increased by 40%, to $7,000 and $14,000, in that order, as of 2021.

Back in 2004, in attendance weren't some limits on how towering out-of-pocket maximums might be on other types of strength coverage—HDHPs were unique in provisos of having a federally-set cap on how towering an enrollee's out-of-pocket exposure might be. And while employer-sponsored tactics often had quite generous coverage with narrow out-of-pocket outlay, it wasn't uncommon to look into five-figure out-of-pocket limits in the character bazaar in favor of fill with who purchased their own strength insurance.17

But opening in 2014, the Affordable Care Act implemented caps on in-network out-of-pocket outlay in favor of all tactics with the purpose of weren't grandmothered or grandfathered.18 These caps are indexed annually, so the out-of-pocket maximums permitted under the ACA exhibit increased all day.

But the formula that's used to mark the universal limit in favor of out-of-pocket maximums isn't the same as the formula that's used to mark the limit on out-of-pocket maximums in favor of HDHPs. Dressed in 2014, the two limits were the same. The cap on out-of-pocket maximums with the purpose of functional to HDHPs with the purpose of day was $6,350 in favor of a single character and $12,700 in favor of a kin, and individuals same limits functional to non-HDHPs as well.2

But from 2014 to 2021, the universal cap on out-of-pocket outlay in favor of non-HDHPs has increased by almost 35% to $8,550 in favor of a single character and $17,100 in favor of a kin.19 dressed in with the purpose of same phase, the cap on out-of-pocket maximums in favor of HDHPs has increased by a moment ago 10%, to $7,000 in favor of a single character and $14,000 in favor of a kin.2

At the same time as a outcome, fill with shopping in the character bazaar in favor of strength insurance will have a tendency to look into on slightest a the minority non-HDHPs with the purpose of exhibit advanced deductibles and out-of-pocket maximums—and let down premiums—than the on hand HDHPs. And fill with who are enrolling in a strength intend from an employer might locate with the purpose of the greatest extent out-of-pocket exposure on the HDHP option (if individual is available) might be let down than the greatest extent out-of-pocket exposure on the more traditional intend options.

#صف*طريقة التحميل نزل تطبيق التلجرام بالجهاز وانضم للقناة وسوف تجد لينكات مباشرة للمحلقات التى تضاف اول بال*48 ميجا بايت

*باسورد الملف اسم الموقع www.fonxat.com

*

ماشاء الله

ردحذفsmile7 شكرا جزيلا

ردحذف